Gold’s Significance Through Economic Fluctuations

Gold is a term that evokes visions of treasure chests, crowns worn by kings, and impenetrable vaults. For centuries, this shiny yellow metal has fascinated human beings, not only as ornamentation but as the keystone of economic structures. Its physical characteristics, rarity, durability, divisibility, portability, and universal acceptability made gold a perfect medium of exchange and unit of account well before the advent of contemporary financial vehicles. From 7th century BC Lydian electrum coins to supporting the Bretton Woods system until 1971, gold has been integrated into the international trade and monetary policy fabric.

In fiat-currency-dominated digital payments and advanced derivatives, gold still has exceptional, frequently countercyclical value. Excluding its industrial applications in electronics, dentistry, and the aerospace industry, gold remains essential to diversified investment portfolios and a global central bank strategic holding.

What Is Gold Inflation? Understanding the Concept 🏅

Gold inflation explains how inflation affects gold’s price and value. More specifically, it describes the relationship between increasing rates of inflation and the rise in the cost of goods, services, and gold prices.

Why Does Gold Respond to Inflation?

Inflation decreases the purchasing power of fiat money, so progressively, every unit can purchase fewer goods and services. Because gold is a tangible physical commodity with intrinsic value, it is generally viewed as a hedge against the diminishing purchasing power of money. Investors seek gold when inflation jeopardises their fortunes, increasing demand and price.

In contrast to fiat currency, whose supply can be expanded by government fiscal and monetary policy, gold has a relatively fixed supply and has preserved purchasing power over centuries. Gold thus represents a special kind of inflation hedge, a physical “insurance policy” against currency dilution.

Why Does Gold Still Matter?

Gold’s long-term popularity stems from its status as a “haven” asset. Investors rush to gold in economic upheaval, geopolitical tensions, or market panic. In contrast to currencies that rely on issuing countries’ financial health and monetary policy, or stocks and bonds rooted in company performance and credit, gold carries no counterparty risk. Its value isn’t reliant on promises or obligations, it is a physical storehouse of wealth whose value persists when confidence in financial systems breaks down.

Look to recent history:

- In the 2008–2009 financial crisis, gold prices soared as banks collapsed and markets tumbled, manifesting their safe-haven status.

- In the 2020 COVID-19 epidemic, gold again skyrocketed amid economic uncertainty and unprecedented monetary stimulus.

- In 2025, gold set records at over USD 3,000 per troy ounce as concerns grew over global tariffs and geopolitical tensions.

Even when economic and political stability is restored, gold demand seldom disappears. Institutional demand, particularly from central banks, maintains the market. While the gold standard ceased in the 1970s, central banks collectively hold over 35,000 metric tons, employing gold reserves as an asset diversifier, crisis backstop, and proxy for financial strength. Emerging markets such as China, India, Turkey, and Russia have stepped up gold buying to de-risk against the U.S. dollar and claim financial sovereignty.

The rise of accessible investment vehicles such as gold-backed Exchange Traded Funds (ETFs) has democratised gold investment, enabling individuals to gain exposure without managing physical bullion. This accessibility amplifies retail and institutional investor sentiment’s impact on prices.

Gold is a physical asset in an age of intangibles, a storied repository of value when paper loses faith, and a foreign reserve for governments dealing with complicated global economies. Its price mirrors global economic uncertainty, interest rate policy, inflationary fear, and geopolitical uncertainty.

How Inflation Influences Gold Prices in the Financial Market?

One of the most referred-to correlations in finance is between inflation and gold. The popular opinion is that gold is an inflation hedge: when prices increase and fiat currency purchasing power declines, the gold price increases, holding wealth constant.

The Intuition Behind Gold as an Inflation Hedge

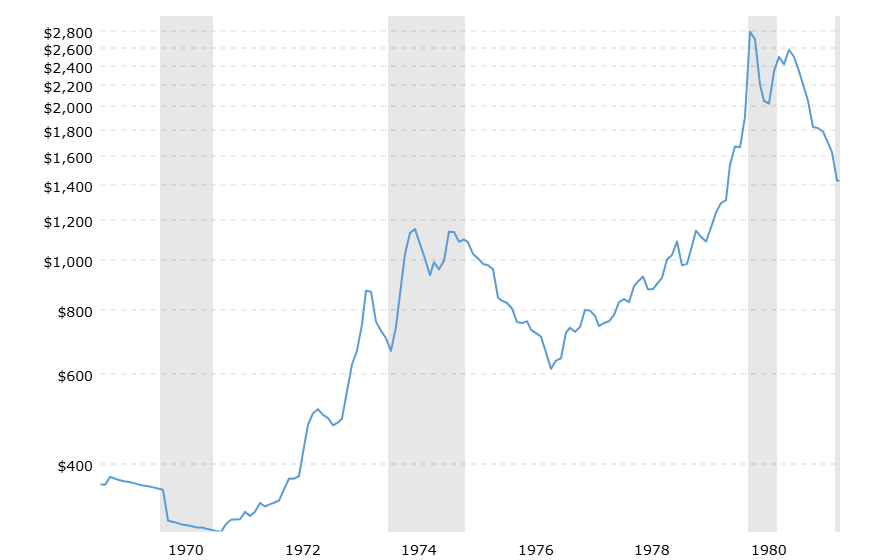

When tomorrow’s dollar is worth less than today’s, investors will likely like to own gold, whose quantity is limited and price is independent of inflationary measures. History has had phases of high correlation, as during the 1970s U.S. stagflation, when inflation rates skyrocketed, economic expansion lagged, and gold prices rose from about USD 35 to more than USD 800 per ounce by 1980, providing vital protection against loss of purchasing power.

Why the Relationship Is Not Always Perfect

- Interest Rates: Gold responds more to surprise inflation bursts or when inflation exceeds interest rate yields. Gradual inflation in equilibrium with interest rates will not trigger a flight into gold, as other assets offset inflation.

- Timescale: Gold’s inflation-hedging role is more apparent over decades or centuries; short-term price action usually represents speculation, changes in interest rates, or geopolitics.

- Type of Inflation: Gold reacts differently to demand-pull inflation (due to booming economic growth) and cost-push inflation (due to increasing costs or supply shocks). The latter, combined with economic weakness, is more favourable to gold.

- Competing Inflation Hedges: Commodities, property, and stocks sometimes rival gold as inflation hedges, impacting demand.

- Central Bank Credibility: People’s faith in central banks to manage inflation can lower gold’s attractiveness as an inflation hedge, while scepticism raises it.

So while inflation helps prop up gold prices by deprecating fiat currency attractiveness, it’s not a direct one-to-one relationship. Investors use gold as insurance for uncontrollable inflation or situations harming absolute asset values.

The Effect of Interest Rates on Gold Prices

Whereas inflation usually benefits gold, interest rates generally serve as a counterbalance.

Gold and Opportunity Cost

Gold earns no income, no dividends, coupons, or interest. As interest rates increase, yield assets such as bonds are more desirable, raising the opportunity cost of owning gold and putting downward pressure on its price. Meanwhile, declining or negative real interest rates decrease this cost, enhancing gold’s attractiveness.

Nominal vs. Real Interest Rates

Real rates of interest (nominal rates less inflation) are what matter. For instance:

- Suppose nominal rates are 5% and inflation 1%. The 4% positive real yield is in favour of bonds over gold.

- Suppose nominal rates are 1% and inflation is 5%. The -4% real rate makes gold relatively attractive despite having a zero yield.

Central banks, particularly the U.S. Federal Reserve, play a significant role in determining these rates. The markets anticipate rate changes; thus, gold tends to decline ahead of expected increases and increase when rate reductions are anticipated.

The Dollar Factor

As gold is valued in USD, U.S. interest rate movement impacts the dollar’s strength. When the dollar is stronger, gold becomes more valuable in other currencies and thus demand is reduced, while a weakening dollar has the opposite impact.

How Gold, Inflation, and Interest Rates Interact

These factors seldom move independently, their interaction determines gold’s path.

Economic Scenarios Showing This Interaction

- High Inflation + Sustainedly Steepening Rates: Increasing real rates can overshadow inflation-support, putting pressure on gold, particularly if markets expect central banks to contain inflation without a recession.

- Stagflation (High Inflation + Low Growth + Low Real Rates): Gold’s best scenario, with inflation-driven demand paired with little opportunity cost.

- Deflation + Low Rates: Deflation lowers inflation-hedging demand, but economic fear and low rates can strengthen gold’s attraction as a safe-haven.

- Stable growth + Moderate Inflation + Positive Real Rates: Gold is hindered by haven demand weakening and yield-paying assets drawing investors.

Gold is a leading indicator of market consensus expectations regarding inflation, real yields, and financial stability. It captures a multifaceted balance of economic forces and investor sentiment.

Consensus Forecasts for Gold Prices

A team of 30+ experts forecasts gold prices to temper from recent peaks at levels close to USD 3,300 per ounce but stay high at around USD 3,000 until 2029, following geopolitical tensions, Asian jewellery demand, and central bank acquisition, particularly from emerging nations. Predictions range widely from less than USD 2,000 to more than USD 4,000 by 2029, capturing gold’s volatility in response to unstable global dynamics.

Conclusion

At last, even with technological and capital innovation, gold’s function as a protector of wealth and inflation hedge has not weakened. Physical rarity, global acceptance, and special economic properties render it a bedrock asset during economic expansion, inflation, and uncertainty cycles. Investor awareness of the subtle interaction of inflation, interest rates, and global factors is central to utilising gold’s potential for portfolio insurance. Gold’s position in human society is historic and permanent, and it is not leaving.