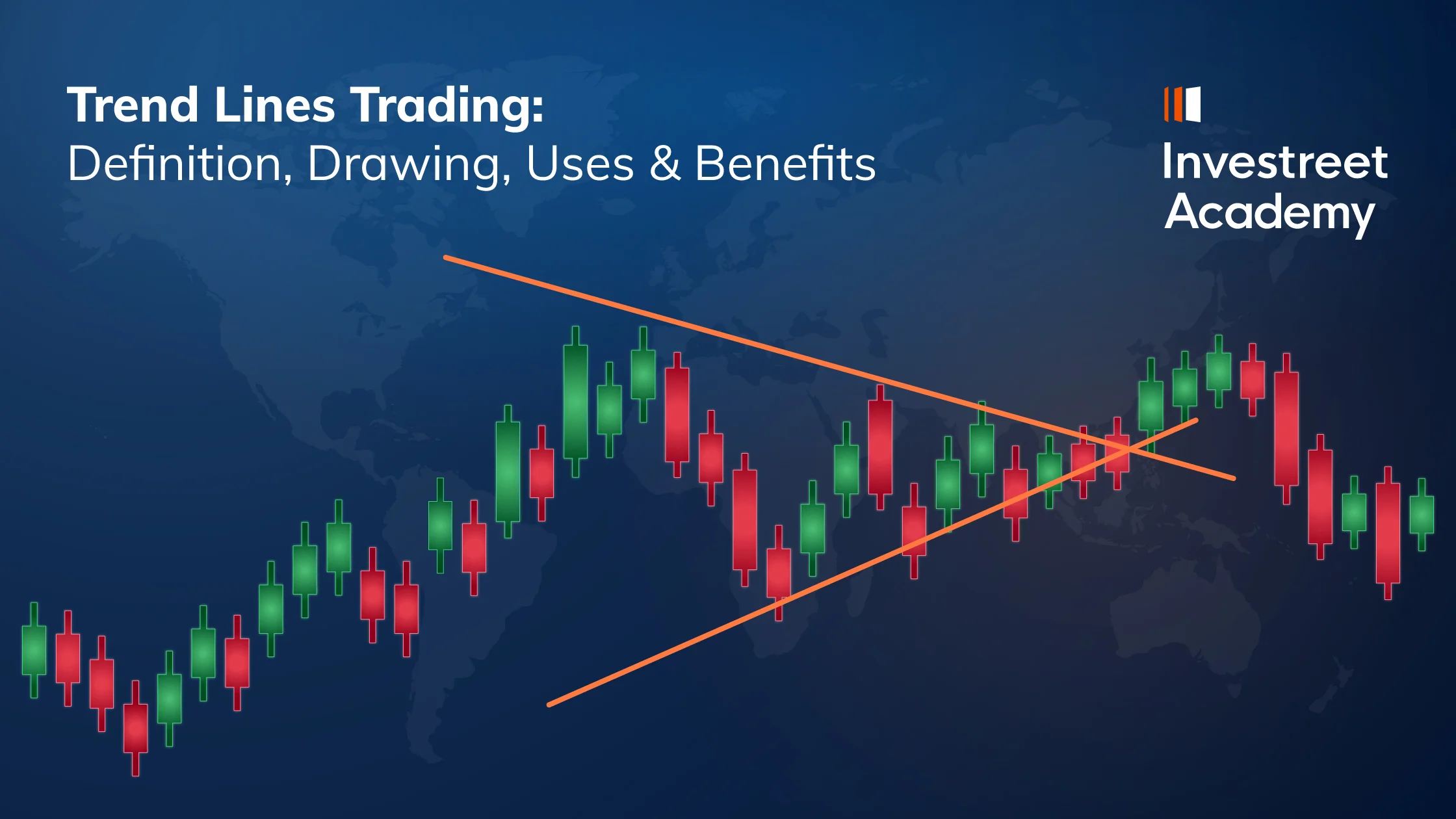

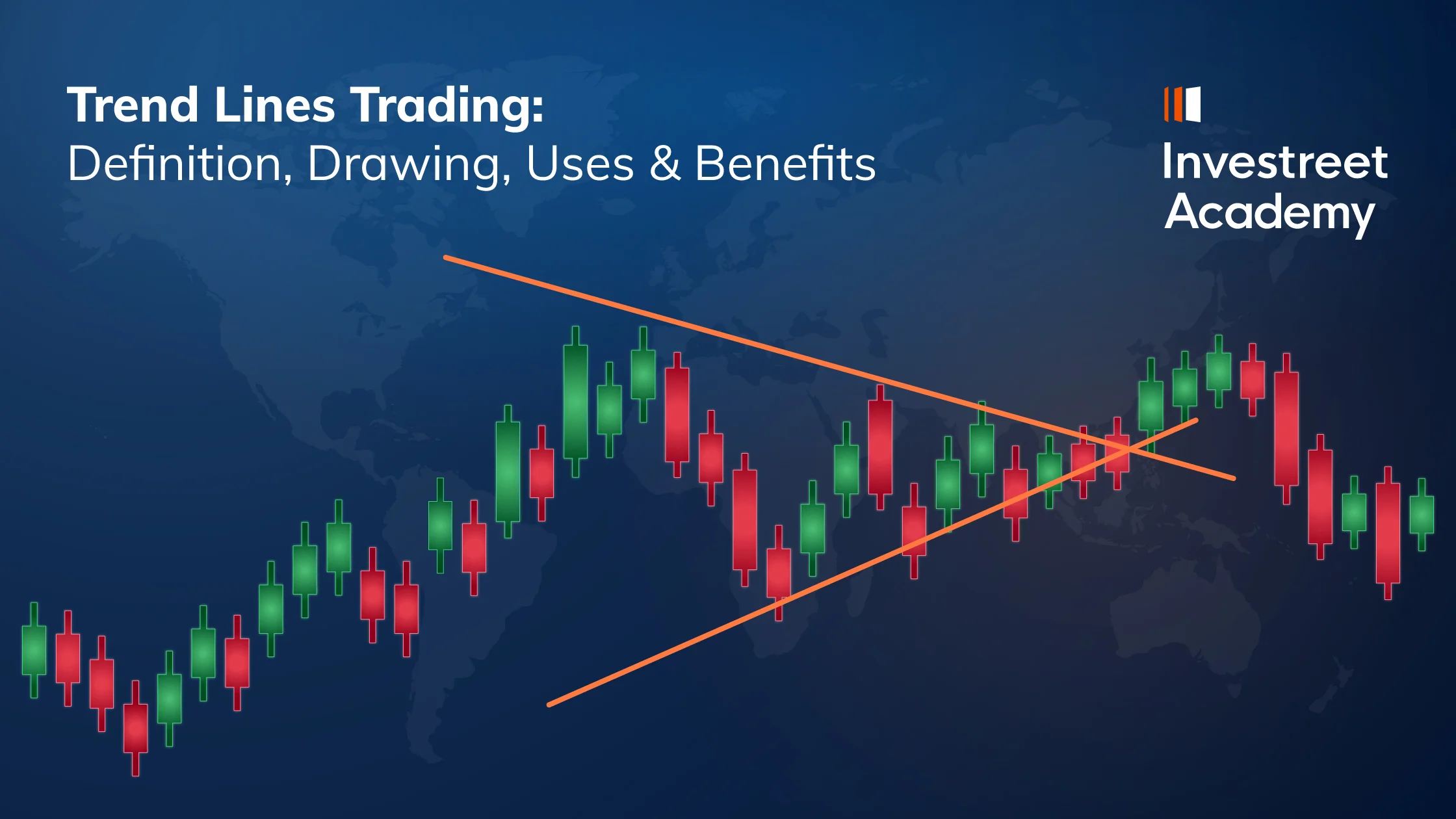

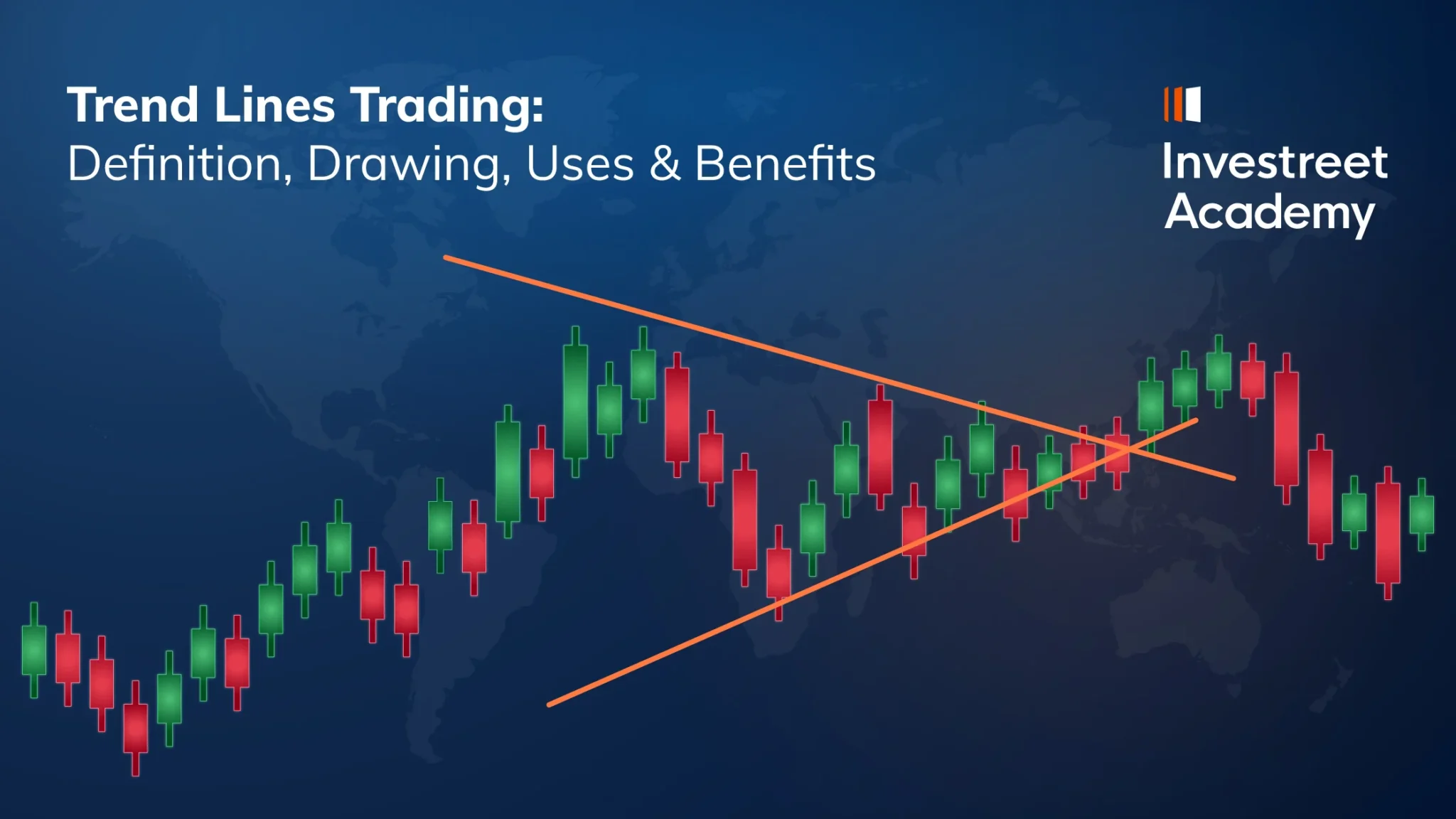

Trend lines Trading: Definition, Drawing, Uses & Benefits

What Are Trend lines in Trading? A Simple Guide for Beginners When you first look at a trading chart, all the price movements, such as

Trading indicators are analytical tools that help traders make sense of price movements. By using historical data and market behaviour, indicators can reveal trends, signal momentum shifts, and highlight potential entry or exit points. Indicators are essential for navigating the markets with confidence. It’s a trader’s best friend.

Financial markets move rapidly and often unpredictably. Indicators offer structure and insight by helping you in your trading journey. Whether you’re just starting or refining your edge, indicators provide structure in a fast-moving market.

What Are Trend lines in Trading? A Simple Guide for Beginners When you first look at a trading chart, all the price movements, such as

What Are Trend lines in Trading? A Simple Guide for Beginners When you first look at a trading chart, all the price movements, such as