The foreign exchange (forex) market is the largest and most liquid financial market globally. Traders in such a big market should be aware of the two main key concepts: financial leverage and margin. They are two sides of the same coin, amplifying both profits and losses. We will break down what leverage and margin mean, how they work, and explain related concepts, such as margin requirements, required margins, and margin calls. We’ll also examine the relationship between leverage and margin, discuss how to use it reasonably, and highlight the pros and cons of using leverage.

What is Leverage in Forex Trading?

Leverage is also referred to as gearing in finance. The concept of leverage is common in forex trading. Leverage in trading enables traders to control larger market positions with relatively less capital.

It also means using borrowed money to invest; this is the approach traders typically take, borrowing money from their trading broker and then trading larger positions in a currency. They can trade with more money than their initial deposit, increasing their potential gain.

As a result, leverage magnifies the returns from movements in currency pairs. However, it also increases their potential losses, so leverage is considered a double-edged sword, as it magnifies both gains and losses. Therefore, it requires a high level of risk management techniques. Now it’s time to understand how leverage truly works.

How does Leverage work?

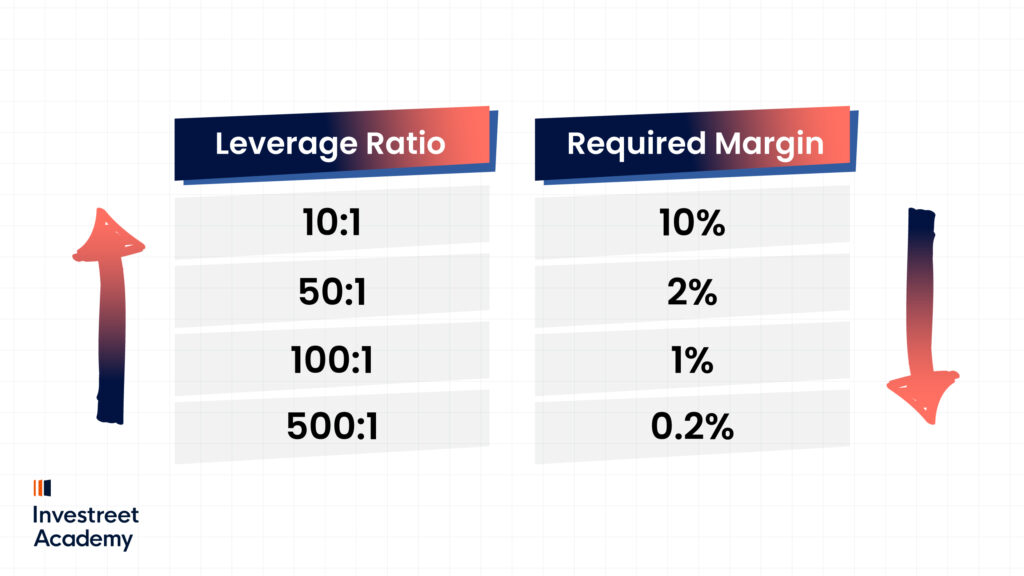

When you open a leveraged trading account, it means you will deposit only the margin, and your broker will supply the remaining full value of the positions that are opened. Think of it as a loan from the broker that boosts your trading capacity and capital. Leverage is typically expressed as a ratio. Let’s have a look at an example of leverage ratio types below.

Leverage Ratio Types:

|

What do 1:50, 1:100, and 1:200 mean in leverage ratio?The leverage ratio represents how much the trade size can be magnified relative to the margin held by the trader. The initial margin required by each broker can vary depending on the size of the trade and the broker’s policy. |

For instance, if you buy a $100,000 GBP/USD contract, you might be required to hold above $1,000 in your account as collateral (called margin). This indicates that the margin requirement is 1%. Expressed as a leverage ratio, this would be 100:1, meaning that a deposit above $1000 enables you to control a $100,000 value contract in a specific currency pair.Common leverage ratios are usually 50:1, 100:1, and 200:1, with some brokers offering leverage up to 500:1. To truly understand leverage, it’s important to examine what the margin is in forex trading, as it serves as the collateral for leveraged trading.

What is Margin in Forex Trading?

In forex trading, margin refers to the initial deposit required by a broker to allow you to open and maintain a leveraged position. The margin is often misunderstood as a fee or cost, but it is a portion of your capital that is reserved or set aside with your broker. This portion is just a security deposit to cover potential losses that may occur.

It’s called collateral margin because it’s your own money. If you open a trading position and your trade comes in your favor, the margin is released back to your available balance once you exit the position, along with your profits.

Conversely, if your trade incurs a loss, it will be deducted from your total account equity. If the losses surpass your margin, a margin call will be triggered. To understand what a margin call entails, let’s proceed to the next section on how margin works in forex trading.

How does Margin work in Forex Trading?

Margin trading involves borrowing funds from your broker to control a larger position, similar to leveraging in the markets. Margin trading enables traders to control a position with less than the full cash amount needed. It requires a solid understanding of related concepts, such as margin requirements, required margins, and margin calls.

Margin Requirement:

It’s considered a rule used to calculate the required margin. It’s the percentage of the total trade value that the trader must deposit to maintain a leveraged position or margin trading. It’s essential security for both brokers and traders, ensuring that traders have enough capital to cover potential losses.

Required Margin:

The required margin is considered a specific type of margin. It refers to the exact amount traders need to maintain a trade. It’s calculated by multiplying the margin requirement by the total position size.

If you want to open a position worth a $200,000 contract and the broker has a margin requirement of 2%, the required margin will be 2% of $200,000, which is $ 4,000. Thus, you need to deposit or have an equity of over $4,000 to open that position.The Formula is: Margin = Total Position Size x Margin Requirement

Margin Call:

It’s an alert issued by the broker, requesting the trader to increase their capital or sell assets when the account’s equity falls below the margin.

If a trader receives a margin call and fails to deposit more funds or sell assets, the broker will force liquidation. The broker will protect the remaining equity by selling some or all of the open positions to bring the account back up to the required margin level. As mentioned earlier in this article, if losses exceed the margin level, a margin call will be triggered.

The Relationship Between Leverage and Margin:

Leverage and margin are two sides of the same coin in leveraged trading. When trading with leverage, you only need to deposit a percentage of the trade’s value as collateral, known as margin, rather than the full value of the trade. This margin serves as a security deposit to cover potential losses.

Leveraging allows you to increase your trading position size relative to your margin. With 10:1 leverage, you can control a position that is ten times larger than your deposit.

We can say that the relationship between leverage and margin is inverse; the higher the leverage, the lower the margin requirement, as the following table illustrates:

Notably, a higher leverage ratio can reduce the margin required per trade. However, investors should avoid overtrading because it increases their risk, as even small price movements can be magnified. It’s crucial to keep risk management in your mind, along with margin usage. Let’s review the key risk management points to learn how to use leverage reasonably in your trading strategy, including leveraging trading.

How to Use Leverage Responsibly?

As mentioned earlier, the mistake of using margin trading is a double-edged sword that can magnify profits while also increasing potential risks. To mitigate these risks, it is essential to adhere to specific practices.

Ask for your Broker’s Margin Requirements:

The margin requirements vary from one broker to another. You have to be familiar with these requirements, ensuring that you have sufficient capital in your trading account to meet them.

Two traders each have a deposit of $1,000 but different leverage ratios, such as 50:1 and 100:1. With a 50:1 leverage ratio, the required margin per trade is higher (2%), while with a 100:1 ratio, it is lower (1%).

If both traders open a trade that moves against them by 1%, they will incur a loss of $500. Notably, the traders’ ability to maintain their positions depends on their capacity to defend their margins. For example, taking a position of 10,000 units, or 0.1 lot, the required margin for a 50:1 leverage is $200, whereas for 100:1 it is $100.

Therefore, with a leverage ratio of 50:1, the equity balance will be $800 after opening the position (excluding spread and any charges), whereas with a 100:1 leverage ratio, it will be $900. The key point is that the trader can sustain their position until the margin call difference reaches $100.

Stop-loss order Usage:

Regardless of the account leverage ratio, it’s crucial to utilize risk management tools such as stop-loss orders. These are automatic orders that close a position once it reaches the predetermined price level. You simply decide the level at which to limit potential losses. It acts as a safety net, protecting you from losing more than you are willing to risk.

Continuous Monitoring of Trades and Margin Levels:

Regularly check your open positions to ensure you have sufficient capital available. Always check your margin level to avoid a margin call. This will mitigate risks associated with margin trading and optimize outcomes.

Proper Position Sizing and Capital Allocation:

It’s crucial for long-term trading success to master position size and capital allocation. Begin by determining the amount of capital to risk per trade. Consider your risk tolerance and the size of your account relative to the leverage ratio you have. Choosing the right position size in proportion to your leverage is a key step in managing risk. By doing so, you can effectively manage your exposure to downturns and high volatility, helping you avoid huge losses.

Don’t Overleverage:

Select a leverage and open position ratio that aligns with your risk tolerance. It’s not mandatory to use a high ratio of leverage and engage in overtrading to achieve high profits. You can generate profits through a reasonable ratio of leverage and an appropriate number of open positions, combined with a proper trading strategy and effective risk management techniques.

Pros & Cons of Using Leverage in Forex:

|

|

Increase Buying Power: Leverage trading allows traders to control a large trade position with less capital, providing more exposure with limited funds, and amplifying potential profits. Increase Buying Power: Leverage trading allows traders to control a large trade position with less capital, providing more exposure with limited funds, and amplifying potential profits. |

Increase the margin call risk: In case the available balance falls below the maintenance margin, the trader will face a margin call and, in response, will be forced into liquidation. Amplifies potential losses. Increase the margin call risk: In case the available balance falls below the maintenance margin, the trader will face a margin call and, in response, will be forced into liquidation. Amplifies potential losses. |

It gives wider access to more market opportunities. It gives wider access to more market opportunities. |

Can lead to overtrading or emotional decision-making. Can lead to overtrading or emotional decision-making. |

It’s suitable for a short-term trading or scalping strategy. It’s suitable for a short-term trading or scalping strategy. |

It needs regular monitoring and discipline. It needs regular monitoring and discipline. |

The Bottom Line:

In conclusion, trading with leverage and margin can enhance profit potential, but it also increases the risk. Traders need careful risk management, a solid understanding of margin requirements, and disciplined trading strategies to avoid significant losses, to effectively monitor the trades, and achieve long-term success.