What Drives The Gold & Oil Market?

Gold and Oil are strategic assets that are affected by many factors. They are the most traded commodity in the forex markets. Both assets have similarities and differences. Traders should be aware that gold and oil correlate; being familiar with these areas may enhance their trading strategy.

Let’s delve into the details of all the factors affecting Gold & Oil prices and the correlation between them:

The Basics of Trading Gold (The Safe-Haven Asset):

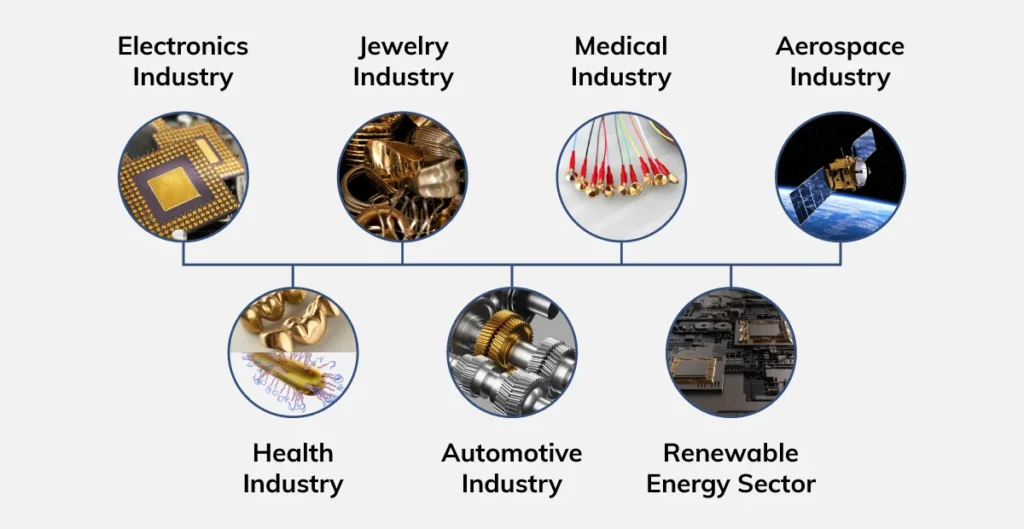

Gold is a highly valued commodity and considered a store of value, aside from its use in jewellery. Gold has important applications in engineering, electronics, and medicine. It’s a strategic asset because it has a long track record of delivering good returns over the long run and hedging from inflationary impacts.

It’s also considered an effective diversifier within the portfolio due to its negative correlation with equities during market downturns; additionally, gold can deliver positive returns during market expansions. Gold is a highly liquid asset, so adding even a small part of gold investment during the asset allocation process will improve the risk-adjusted returns of the portfolio, particularly within a stock/bond portfolio. This will reduce the volatility and drawdowns.

The most famous way to invest in gold and benefit from its price fluctuations is trading gold in the Contract for Difference markets (CFD) markets, which allow investors to trade the direction of securities over a very short term. The advantage of Gold CFDs is that they require a lower capital, provide leverage, and a short-selling option, which allows investors to benefit from both rising and falling gold prices.

Factors Influencing Gold Prices:

There are many factors influencing the gold prices, including economic uncertainty, Inflation, Interest rates, Geopolitical events, and Supply and demand.

- Supply and demand:

Supply and demand are fundamental factors that influence the gold prices. The higher the demand for gold, the higher its price; conversely, the lower the demand, the lower its price. The level of supply includes mining production, recycling, and central bank reserves, all of which can affect the overall availability of the gold trading market. On the other hand, the level of demand fluctuates according to various factors such as jewelry manufacturing, industrial uses, and investment demand. However, the demand for gold could decrease despite a high level of supply, due to situations such as recession, higher interest rates, or other assets performing better, resulting in lower gold prices.

- Inflation Rate:

Inflation refers to an increase in the price of goods and services in an economy. When the economy experiences a high inflation rate, its currency loses value, prompting people to seek safe-haven assets. Therefore, gold prices tend to increase during periods of high inflation rates. People prefer holding their money in gold because gold’s value tends to appreciate over time. During periods of high inflation rates, the demand for gold increases as a hedge against inflation.

- US Dollar strength:

The US dollar’s strength is inversely related to the gold prices. Since gold is priced in US dollars, the stronger the dollar, the weaker the gold price. When the US dollar strengthens, the gold price becomes more expensive for the international buyer, which decreases gold’s demand and puts downward pressure on prices. Conversely, a weaker dollar makes gold comparatively cheaper and can catalyze demand, allowing gold prices to rise. It’s very important to monitor the performance of the US dollar to anticipate gold price movements.

- Central Bank Reserves:

Central banks around the world tend to hold significant gold reserves to diversify their reserves. As banks are responsible for their nation’s currencies, they must have gold reserves to hedge against swings in value, depending on the perceived strength or weakness of the underlying economy. The central bank’s policies can impact the market’s supply and demand dynamics. After all, when the central bank increases its gold reserves, it signals confidence in the yellow metal, which leads to higher demand for gold, as people often follow the central bank’s policies; consequently, gold prices increase. Conversely, when central banks sell off their reserves, this may increase the gold supply, potentially lowering prices. Furthermore, the interest rates and monetary policies implemented by central banks influence gold prices.

- Central Bank’s Monetary Policies & Interest Rates:

Central bank’s policies have a significant impact on gold prices. Whether they followed an expansionary or contractionary monetary policy, either policy can impact the prices. Interest rate anticipation is crucial for gold investors, helping them make informed decisions on when to buy or sell gold accordingly.

When the central bank policy is expansionary, this means that the government increases spending and lowers interest rates; in this case, gold investment will be more attractive than the low-interest-rate investments, which don’t generate income, and the gold price will be relatively lower compared to other investments. As a result, demand for gold may increase, driving prices up.

Conversely, when the central bank’s policy becomes contractionary, this means that they will increase the interest rates to support the currency and attract investments so it’s all about the opportunity cost; at this time investors will shift their investments towards interest bearing assets, reducing the demand for gold and potentially lowering gold prices.

The Basics of Trading Oil (The Energy Commodity):

Oil trading includes the exchange of crude oil, the world’s essential and highly valued commodity. It’s considered the backbone of the global economy, it’s a primary energy source, and a critical raw material. Crude oil is consumed across the world.

Oil prices are sensitive to global economics and geopolitical events; its prices can be volatile and sharply fluctuate in response to major news or unexpected events. The dynamics of supply and demand also influence oil prices.

Worthy note that multiple oil prices are derived differently, such as WTI Crude oil, the benchmark in oil futures contracts traded on CME’s New York Mercantile Exchange, Brent crude oil is the international benchmark used in Europe, OPEC Basket refers to the aggregate price for the produced and exported oil by OPEC’s countries while Saudi Arabis is the key member. Oil trading can also be done through CFDs. So you can benefit from the short selling, lower capital, and leverage advantages.

Factors Influencing Oil Prices:

Oil prices can be influenced by key factors that can lead to significant fluctuations in prices.

Monitoring these factors is important for traders just to avoid risks caused by unexpected volatility. When you are watching the key factors influencing the market, you can avoid trading at this time, or you can close your open positions.

- Supply and Demand:

The primary driver of oil prices is the balance between global oil supply and demand. During a limited supply, oil prices tend to increase. For example, in the 1970s, the oil crisis took place, and oil prices tripled due to supply disruptions. Conversely, the oversupply or weakening demand can drive the oil prices to fall.

- Global economic growth:

Generally, during periods of good global economic growth, oil prices tend to increase, and during a recession, they tend to fall. When the global economy is growing, it means there is substantial industrial activity, improved transportation, and continuous energy consumption, resulting in high demand and rising oil prices. On the other hand, if a recession occurs, it means that overall consumption is limited, resulting in lower demand, which in turn causes prices to fall.

For instance, the world faced many crises that significantly influenced oil prices, such as:

- In 2008, the global economic/financial crisis occurred.

- In 2020, the OPEC/Russia price war.

- COVID-19, in recent times, disrupted the global supply chain and aggregate demand for both oil-exporting and oil-importing economies.

- The lockdown restrictions led to a significant reduction in oil prices on the global market, from $61 on January 2, 2020, to $12 on April 28, 2020.

- Geopolitical events:

During geopolitical shocks, oil prices are influenced by lower economic activity, which negatively affects the supply chain and increases volatility, ultimately driving oil prices upward. Particularly, any conflicts or uncertainties that occur in oil-producing regions, such as the Middle East or Russia, can lead to disruptions in the supply chain. Additionally, sanctions or bans on major oil producers can impact global supply, often leading to increased prices.

- OPEC decisions:

OPEC is responsible for regulating the supply of oil to set the price on the world market. The organization of the petroleum-exporting countries refers to a group of 12 major oil exporters. OPEC decides the production quotas and when to cut or increase oil output. Its decisions have a significant impact on the global supply, which in turn affects oil prices. Traders usually watch the OPEC meeting closely to anticipate future price movements.

The Bottom Line:

Trading commodities like gold and oil requires a significant understanding of the factors that affect their prices. When trading a strategic asset, it is essential to be aware of all internal and external factors that affect its price to minimise risks associated with price volatility. Success in trading commodities stems from mastering the key factors that influence the underlying asset, selecting an effective trading strategy, and determining your risk tolerance. Be aware that profitable trading requires a disciplined approach and a systematic strategy.